From Gold to Fiat – How Nixon Changed Money Forever

- The Chairman

- Aug 15, 2025

- 2 min read

Lesson Plan: From Gold to Fiat – How Nixon Changed Money Forever

Grade Level: 9–12

Subject: Financial Literacy / Economics / U.S. History

Class Length: 90 minutes

Title: The Day Money Changed – Understanding Fiat Currency & Inflation Since 1971

Florida State Standards

SS.912.E.1.2 – Explain how economic systems influence production and distribution.

SS.912.E.1.3 – Compare the basic characteristics and functions of economic systems, including property rights, incentives, economic freedom, competition, and role of government.

SS.912.E.2.1 – Analyze the role of government in a market economy.

SS.912.A.7.6 – Assess key economic issues of the 1970s and their impact on American society.

MA.912.DP.1.1 – Collect, represent, and interpret numerical data, including percentages and rates of change.

Lesson Objectives

By the end of this lesson, students will be able to:

Explain what the gold standard was and why the U.S. abandoned it in 1971.

Define fiat currency and understand how it differs from commodity-backed money.

Analyze the effects of inflation on purchasing power over time.

Calculate the change in the dollar’s value since 1971 and relate it to real-world examples.

Discuss how monetary policy impacts personal financial decisions.

Materials Needed

Projector/Smart Board

Inflation calculator (online or printed chart)

Chart showing U.S. GDP growth vs. dollar value decline since 1971

Handouts with definitions: Gold Standard, Fiat Currency, Inflation, Purchasing Power

Lesson Activities

1. Hook (10 min) – “The Dollar Before and After”

Show students a visual of what $1 could buy in 1971 vs. today.

Ask:

“If the dollar has lost over 80% of its value, who benefits and who loses?”

2. Direct Instruction (15 min) – The End of the Gold Standard

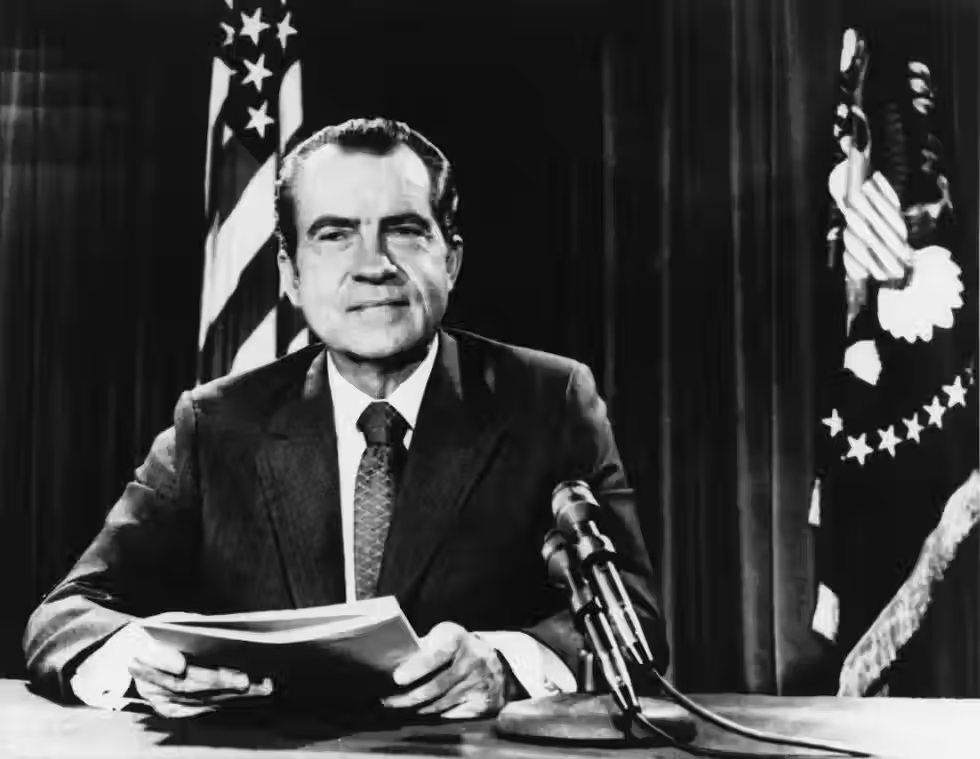

Explain the gold standard and Nixon’s 1971 decision to suspend dollar-gold convertibility (“Nixon Shock”).

Define fiat currency – money with value because the government declares it legal tender.

Introduce inflation and purchasing power concepts.

3. Data Analysis (20 min) – The Value Drop

Use an inflation calculator to show how $1 in 1971 = $6+ today.

Compare GDP growth (trillions added) vs. dollar value loss.

Students complete a short worksheet calculating how much a 1971 salary would be worth in 2025 dollars.

4. Group Discussion (15 min) – Winners and Losers

Split students into groups:

Group A: Who benefited from the shift to fiat money? (e.g., borrowers, investors, exporters)

Group B: Who was hurt? (e.g., savers, fixed-income retirees)

Groups present findings.

5. Personal Finance Connection (20 min) – Protecting Your Money from Inflation

Discuss strategies: investing in assets, diversifying, earning interest, holding inflation-resistant investments.

Students create a mini-plan to protect $10,000 from inflation over 10 years.

6. Wrap-Up & Assessment (10 min)

Quick quiz: Define fiat money, inflation, and purchasing power.

Short answer: “If you were alive in 1971, would you have supported leaving the gold standard? Why or why not?”

Assessment Methods

Participation in group discussion

Accuracy of inflation calculations

Quiz & short answer reflection

Homework

Students interview a parent/grandparent about how prices have changed since they were a teenager. Write a one-page reflection.

Comments